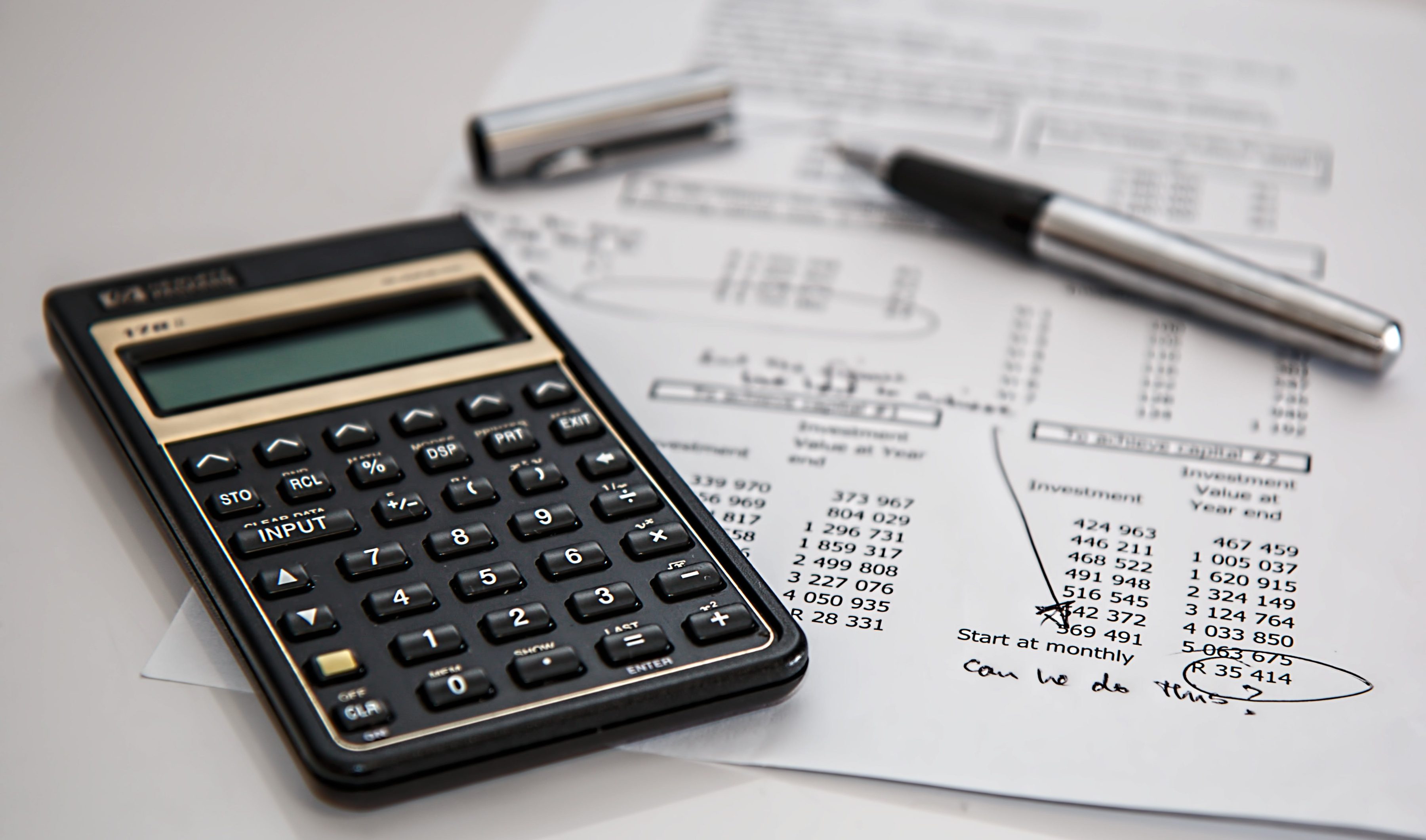

INTRODUCTION TO LITIGATION FINANCE

Litigation finance, or third-party funding, is when an external party covers the costs of commercial disputes in exchange for a share of the resolution proceeds. This non-recourse funding aids businesses and law firms, ensuring access to justice without impacting their control. It levels the economic playing field, addressing rising legal costs and enabling disputes to proceed on merit. This approach is especially beneficial for parties with limited resources, facilitating their pursuit of legitimate legal battles.

FUNDING OPTIONS OVERVIEW

BENEFITS OF LITIGATION FINANCE

Alternative to Loans

Litigation funding, unlike traditional loans, is attractive because it’s non-recourse. Repayment to funders only happens if the case succeeds, avoiding ongoing debt obligations and interest payments. This eases financial burdens for claimants, improving the financial position of companies and law firms.

Focus on Core Competencies

Engaging a third-party litigation funding allows businesses to concentrate on their core activities, improve cash flow management, and direct energy toward their strengths.

Unlock Liquidity and Reduce Risk

Litigation funding operates on a non-recourse basis, ensuring payment only upon claim success. Expertise aids companies in navigating complex cases for a positive, risk-free outcome.

Level the Playing Field

Litigation funding empowers smaller players by providing essential capital, leveling the playing field against larger opponents. This enables them to pursue rightful claims without financial constraints, resisting low-ball settlement offers and ensuring resolutions based on legal strength rather than financial power.

Unlock Value for Companies

Access to high-caliber lawyers: Companies can afford top-tier legal representation, enhancing their legal strategies.

Expense Optimization: Litigation finance shifts legal spending, potentially turning legal departments into revenue sources and releasing capital for other priorities.

Margin Improvement: It helps improve enterprise margins by strategically managing legal expenses.

Our Approach

JusticeWings Lexpay offers all-encompassing financing for legal expenses, covering court fees, compliance costs, lawyer fees, consultation, documentation, diligence, arbitration, and drafting fees.

Currently, we fund commercial cases with strong merits and a significant investment-to-settlement value ratio. Our stringent criteria involve a thorough diligence process assessing case strength, damages claims, and economic viability. The following outlines key steps and factors guiding our determination of crucial criteria.

Understanding our streamlined process can aid in the assessment of case eligibility. If uncertain, feel free to reach out for an initial assessment to discuss your case's alignment with our criteria.

Frequently Asked Questions

JusticeWings Lexpay welcomes all individuals, businesses, law firms, and insolvency professionals seeking litigation financing.

At JusticeWings Lexpay, our capital provision agreements explicitly affirm that the client retains full control over litigation and arbitration decision-making. As a passive financier, we refrain from exerting control over legal assets in any manner, except in exceptional circumstances mutually agreed upon with the client.

Commencing with JusticeWings Lexpay incurs no initial cost; our services are entirely free of charge.

The funding arrangement and case documents are considered sensitive and privileged and would be kept confidential. Further, disclosure of commercial legal finance arrangements is generally not mandated by the majority of courts.

We seek cases with monetary damages, strong merits, and a tested legal theory, led by experienced counsel with a proven track record and a clear strategy.

The timeframe to secure litigation finance varies based on factors such as the complexity of the case. Well-prepared cases typically take about a month from initial review to investment.

Funds from JusticeWings Lexpay can be allocated for lawyers’ fees, case-related expenses, or as working capital for general business purposes, depending on the funding agreement only.

After providing financing, JusticeWings Lexpay collaborates with clients to monitor and track case progress during the management process, offering additional value if clients welcome our involvement.

JusticeWings Lexpay extends financing support to companies worldwide, irrespective of their domicile.

Embrace a hassle-free approach to dispute resolution. Let us manage your legal expenses, offering expertise, efficiency, and financial support, allowing you to focus on your business.

Have more questions? Let’s connect.

Our expert team members will clear all of your doubts with utmost transparency and clarity.